Mandarin Capital Partners is looking to make at least one acquisition and three exits by the end of 2018, Partner and Head of DACH Inna Gehrt said.

The private equity firm is in the process of making a buy in Italy in the food sector, Gehrt said. It is also looking to make acquisitions in Germany in sectors such as packaging, machine components and pharmaceutical, she added.

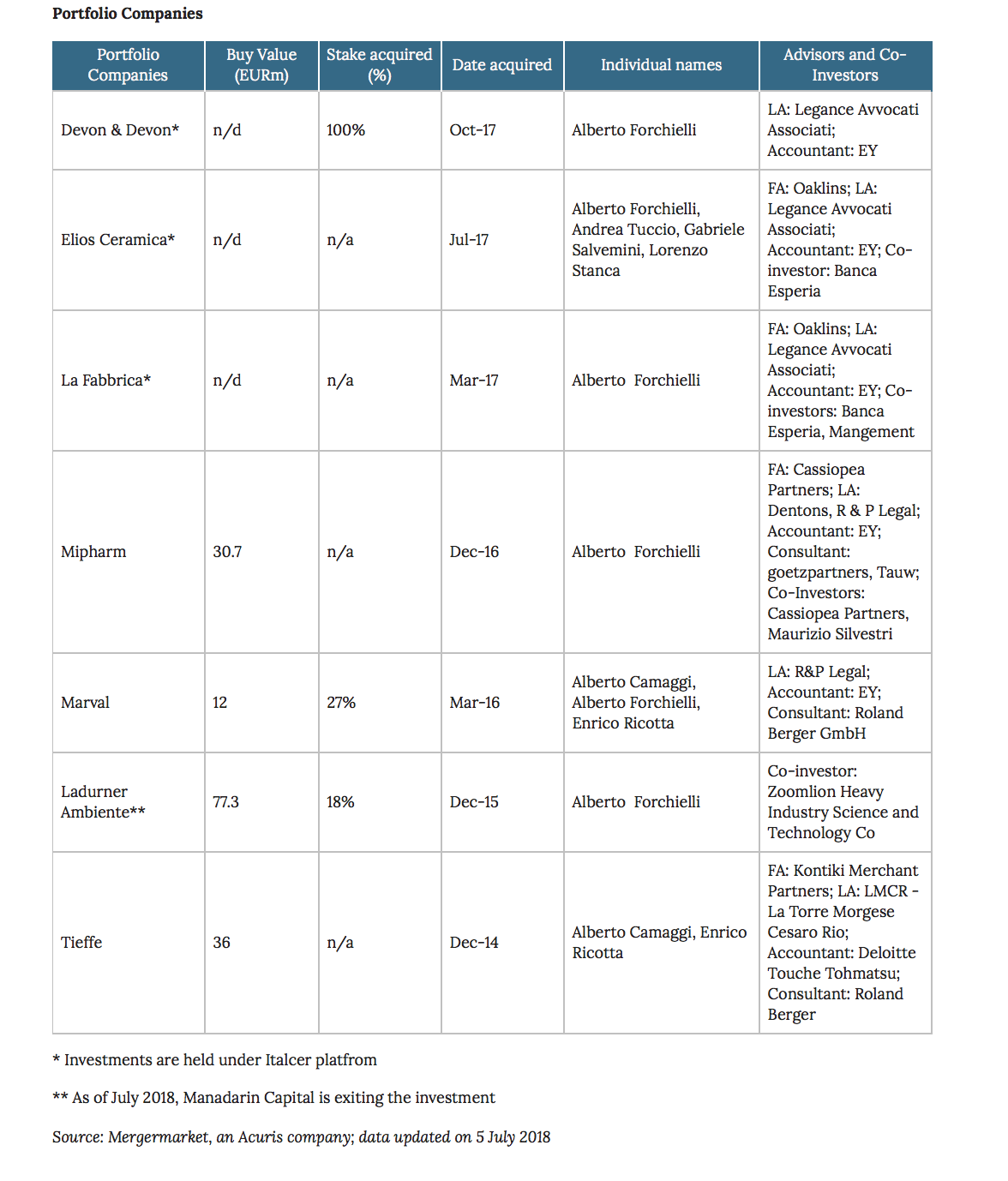

Mandarin Capital Partners is currently exiting portfolio company Ladurner Ambiente, an Italian alternative energy firm, Gehrt said. It will exit Italian industrial components manufacturer Tieffe in October and Italian chassis components manufacturer Marval by the end of the year, she added.

It could sell those companies to either a financial or a strategic buyer, she said. The firm is also looking to make two add-on acquisitions in 2018 for Italcer and will consider listing the holding company of ceramics producers La Fabbrica, Elios and Devon & Devon, she added.

GCA Altium and Fineurop Soditic are advising Mandarin Capital in the sale of Tieffe, this news service reported in April. Tieffe generated revenue of EUR 54m and EBITDA of more than EUR 13m in 2017, the report said.

Marval’s sale is moving into its final stages, Italian-language daily Il Sole 24 Ore reported on 4 July. Sun Capital Partners,Stirling Square Capital Partners and Fondo Italiano d’Investimento (FII), as well as one unnamed strategic bidder could be vying for the asset, the report said, adding that Gianni Origoni Grippo Cappelli is acting as sell-side legal advisor. Marval has a EUR 80m turnover and EUR 18m EBITDA, the report added.

Italcer was last year reported to be targeting a EUR 300m turnover before considering a listing in 2019.

Investment criteria

Mandarin Capital has invested in 15 companies that have made 32 acquisitions so far, three in China and the others mainly in the US and Western Europe, she said. The portfolio companies have shown an average sales growth of 89,8% since Mandarin Capital initial investment, she said.

Mandarin Capital provides support to its portfolio companies for the buy-and-build execution phase by identifying targets to consolidate fragmented markets, Gehrt said. It also identify greenfield sites or overseas partners to improve technology and know-how and drive the portfolio companies’ organic growth. Finally, it gives corporate governance and strategic input at the board level with the help of professionals and industry experts, she added.

To date, Mandarin Capital has raised two funds.

MPC I had a total capital commitment of EUR 327.7m and has been completely divested.

The second fund, MCP II, has a total capital commitment of EUR 195m and approximately EUR 40m dry powder left, she said. MCP II invests in sectors such as specialty adhesives and fabrics, fittings for hydraulic hoses, manufacturing of ceramic tiles, precision machining manufacturing, environmental machining, manufacturing and packaging of pharmaceutical finished dosage forms, she said.

Click here for a full overview of Mandarin’s funds, LPs and investments on Unquote Data, the Acuris platform dedicated to European private equity.

The Eurasia connection

Mandarin Capital Partners supports its portfolio companies through an established presence in China and the Far East, Gehrt said.

It focuses on niche, export oriented European small and mid-cap companies that can benefit from growth strategies in the Far Eastern markets, particularly in China, she added.

European companies can expand into the Chinese and other international markets, establish links with local partners, target acquisitions and reduce supply chain costs, while Chinese firms can build commercial relationships or buy European technology, brands and know-how to increase their market share domestically or on the global markets, Gehrt said.

Mandarin Capital invests primarily in sectors such as pharmaceutical and healthcare, advanced manufacturing machinery, industrial OEM supplies, environmental protection, clean technologies and high-quality consumer goods segments, she said. The interest in certain sectors could vary depending on the economic and political trends in the Far East, she added.

The firm generates proprietary deal flow, Gehrt said. 13 out of 15 deals were closed by the team without going through an auction process, she added.

Its team has an on-the-ground presence in Shanghai, Milan and Frankfurt and an established local network in Europe, China and the US, she said.

It was founded in 2007 and has total staff of 13 people.

by Luigi Serenelli in Berlin, with analytics by Mate Taczman in London

(My colleague Inna Gehrt, head of German Office at Mandarin Capital Partners, interviewed for Mergermarket, article published on July 11, 2018)

MandarinPRESS

Private Equity Spotlight: Mandarin Capital Partners to make at least one buy and three exits in 2018

Alberto Forchielli13 Luglio 20180

Lascia un commento