Dr. Kai Pflug, CEO, Management Consulting Chemicals (Ltd.), Dr. Bernhard Hartmann, Managing Director, A.T. Kearney China Sherri He, Partner, Head PE Practice, A.T. Kearney China

Introduction

Private equity (PE) consists of investors making investments directly into private companies or public companies [note 1]typically, the investors are institutional, so they can commit large sums of money for long periods of time (typically 3-8 years)[note 2] as PE investments often demand long holding periods. This paper gives an introduction into PE in the chemical industry, both on the global level and with a focus on the characteristics of such investment.

Recent history of PE in chemicals

In the mid-1990s, private equity firms started to conduct transactions in the chemical industry. In the subsequent decade from 2000-2009, financial buyers acquired a total of about 150 chemical companies in larger transactions (over US$25 million). Interest peaked in 2003-2005, then fell substantially in 2008 and 2009 but recovered somewhat in 2010. PE thus accounted for a substantial average share (18%) of the global 916 larger chemical acquisitions in the last twelve years, though the PE activity seems even more cyclical than the general M&A activity in the chemical industry. For example, there was almost no PE activity during the financial crisis but PE activities picked up strongly in 2010. The very recent past saw a strong first quarter of 2011 but a slowdown in 2011 as investors started to worry about the overall health of the global economy.

For the near future, several of the key PE players such as Advent, Apollo, Blackstone and Carlyle expect PE to remain an important investor in the global chemical industry. They feel that private equity is capable of accelerating the value creation plans of chemical companies. What are the attractions of the chemical industry for private equity, and also, which characteristics are seen as disadvantages?

For the near future, several of the key PE players such as Advent, Apollo, Blackstone and Carlyle expect PE to remain an important investor in the global chemical industry. They feel that private equity is capable of accelerating the value creation plans of chemical companies. What are the attractions of the chemical industry for private equity, and also, which characteristics are seen as disadvantages?

PE and chemicals

On the plus side, demand for chemical products is comparatively stable compared to more fashion-dependent products. This allows cash generation even in downturns. Many segments of the chemical industry are quite global and have well-developed international markets, which reduces regional risk and also increases the number of potential exit options. As a relatively mature industry, chemicals provide a wide range of targets, many of which have good physical assets, high cash flow, a portfolio of established products and processes as well as a high internal skill level. Other positive aspects of the industry are the fragmentation of some segments (allowing for future gains from industry consolidation, which may even be actively driven by PE) and the frequency of industry restructuring and strategic shifts of the established players. The latter may make targets available at low acquisition multiples, for example, if a chemical company aims to move away from cyclical businesses and thus has a strong interest in selling activities in commodity chemicals.

However, the chemical industry also has its drawbacks for PE investors. The same industry maturity that offers some stability also means that growth rates are relatively low in the typical mature chemicals markets, though less so in Asia and particularly China. Capital intensity is high in commodity chemicals, and raw material costs are highly volatile as most chemical value chains are connected to petrol. As a consequence, profits are also volatile and depend strongly on the status of the business cycle. Finally, chemicals are already highly regulated with regard to safety and environmental legislation, and the rules are expected to tighten further in the future.

However, the chemical industry also has its drawbacks for PE investors. The same industry maturity that offers some stability also means that growth rates are relatively low in the typical mature chemicals markets, though less so in Asia and particularly China. Capital intensity is high in commodity chemicals, and raw material costs are highly volatile as most chemical value chains are connected to petrol. As a consequence, profits are also volatile and depend strongly on the status of the business cycle. Finally, chemicals are already highly regulated with regard to safety and environmental legislation, and the rules are expected to tighten further in the future.

Recent examples

Let us examine a few prominent recent examples of global PE activity in chemicals:

* In 2011, Evonik sold its Carbon Black business to Rhone Capital for US$1.3 billion. This allows Evonik to focus more clearly on its core business in specialty chemicals, and to exit from a commodity business that is under threat from more advanced materials such as silica (also produced by Evonik) with better performance and environmental friendliness. In turn, the PE investor gets access to the strong cash flow and established market position of the Carbon Black business

* Also in 2011, Berkshire Hathaway bought Lubrizol for a total of US$8.8 billion. This allows the acquirer to participate in the market leader of a specialty chemicals segment with high technology entry barriers. At the same time, Lubrizol shareholders receive a substantial premium (+28%) over their share value

* Cytec exited a cyclical commodity business (production of melamine, acrylonitrile, sulfuric acid etc.) via its sale of Cytec Building Blocks to H.I.G. Capital for US$133 million in 2011

* Styron, Dow’s activities covering polystyrene and other plastics, was sold to Bain Capital by Dow in 2010 for US$1.6 billion, providing Dow with resources to extend its higher margin portfolio of technology driven businesses while the acquirer aims to utilize and strengthen Styron’s strong position in the global marketplace

* In 2011, Evonik sold its Carbon Black business to Rhone Capital for US$1.3 billion. This allows Evonik to focus more clearly on its core business in specialty chemicals, and to exit from a commodity business that is under threat from more advanced materials such as silica (also produced by Evonik) with better performance and environmental friendliness. In turn, the PE investor gets access to the strong cash flow and established market position of the Carbon Black business

* Also in 2011, Berkshire Hathaway bought Lubrizol for a total of US$8.8 billion. This allows the acquirer to participate in the market leader of a specialty chemicals segment with high technology entry barriers. At the same time, Lubrizol shareholders receive a substantial premium (+28%) over their share value

* Cytec exited a cyclical commodity business (production of melamine, acrylonitrile, sulfuric acid etc.) via its sale of Cytec Building Blocks to H.I.G. Capital for US$133 million in 2011

* Styron, Dow’s activities covering polystyrene and other plastics, was sold to Bain Capital by Dow in 2010 for US$1.6 billion, providing Dow with resources to extend its higher margin portfolio of technology driven businesses while the acquirer aims to utilize and strengthen Styron’s strong position in the global marketplace

Target selection criteria of PE companies

These examples already highlight one of the most important selection criteria for PE investment in chemicals, the availability of a target at an acceptable price. In general, the chances for PE to acquire targets at a reasonable price are better if there is limited competition from strategic buyers. As a consequence, PE deals often focus on segments that are somewhat unfashionable (e.g., commodity chemicals).

As the key to a successful exit is the value increase of the company during PE ownership (i.e., buyout deal) , targets also need to have some growth/improvement potential.The target should therefore either be in a high-growth segment (though this will mean strong competition from strategic buyers) or offer substantial room for performance improvement.

Different from venture capital, PE (buy out and growth capital) aims to leverage an existing strong base of a company be it a strong technology, strong customer relationships, good product portfolio etc. Companies lacking such strengths are not suitable for PE investment.

Finally, the potential for PE depends on the specific chemical sub segment.

In particular, segments which are still highly fragmented offer particular opportunities as buyout PE investment may help to consolidate the industry, improving overall industry margins (example: strong PE investment in chemical distribution)

As the key to a successful exit is the value increase of the company during PE ownership (i.e., buyout deal) , targets also need to have some growth/improvement potential.The target should therefore either be in a high-growth segment (though this will mean strong competition from strategic buyers) or offer substantial room for performance improvement.

Different from venture capital, PE (buy out and growth capital) aims to leverage an existing strong base of a company be it a strong technology, strong customer relationships, good product portfolio etc. Companies lacking such strengths are not suitable for PE investment.

Finally, the potential for PE depends on the specific chemical sub segment.

In particular, segments which are still highly fragmented offer particular opportunities as buyout PE investment may help to consolidate the industry, improving overall industry margins (example: strong PE investment in chemical distribution)

Valuation

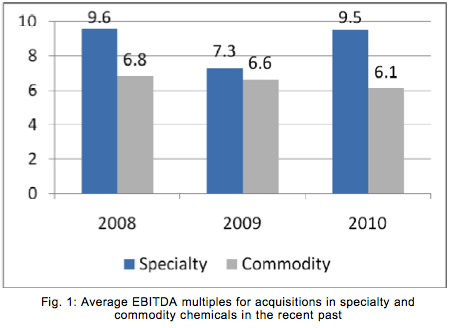

To allow for a profitable exit after a few years, the initial valuation of the target needs to be reasonable. In the recent past, EBITDA multiples have been relatively stable at around 6-7 for commodities. Multiples for specialty chemicals had a higher variation with an annual average between 7-10 (median for specialties from 2004-2008 was 9.1). The higher multiples of specialties reflect the higher margins and lower cyclicality of these businesses.

Generally, financial deals tend to be in the EBITDA multiple range of 4-7, leaving some room for a profitable exit. In contrast, strategic deals may have much higher multiples for example, Clariant recently acquired Sudchemie at an EBITDA multiple of 10.5 while DuPont bought Danisco for an EBITDA multiple of 12.8. Both acquisitions help the companies strengthen strategic core areas and thus presumably justify the high multiples.

Generally, financial deals tend to be in the EBITDA multiple range of 4-7, leaving some room for a profitable exit. In contrast, strategic deals may have much higher multiples for example, Clariant recently acquired Sudchemie at an EBITDA multiple of 10.5 while DuPont bought Danisco for an EBITDA multiple of 12.8. Both acquisitions help the companies strengthen strategic core areas and thus presumably justify the high multiples.

Value creation and exit

Once a chemical company has been acquired by a PE company, the main goal is to improve the price of the company by creating additional value. While in principle all common ways of business optimization may be utilized by PE owners, some models are particularly prominent:

* “Buy and Build” the acquisition and consolidation of several companies in the same chemical segment

* Cost control the focus on optimizing cash flows, costs, and capital expenses

* Simplification of the business streamlining of portfolio, customers and operations to reduce complexity costs

The ultimate goal of a PE firm is an exit, i. e., the sale of the chemical company acquired earlier, which allows to repay the initial investors. There are three basic models for such an exit, of which two are clearly preferred by investors due to the average higher sales price. One of these is the trade sale, in which the company is sold to a strategic player in the same area. Investors may obtain a premium via this type of exit as the buyer can hope to reap synergies later, allowing him to pay a higher price. Of course, a trade sale requires the existence of strong industry players with sufficient resources and strategies that favor business expansion. The acquisition of Cognis by BASF is a recent example. An Initial Public Offering (IPO) may also be quite profitable for the investors, as the example of the Blackstone acquisition of Celanese followed by relisting in the US has demonstrated. A somewhat second-rate exit is the secondary sale, in which the chemical company is sold on to another PE investor. Obviously, the lack of immediate synergies and the presumably high sophistication of the secondary buyer limit the sales price of this type of exit. An example is the secondary buy-out of Brenntag in 2006. The company CABB, a producer of fine chemicals, even went through two such transactions (in 2007 and 2011).

* “Buy and Build” the acquisition and consolidation of several companies in the same chemical segment

* Cost control the focus on optimizing cash flows, costs, and capital expenses

* Simplification of the business streamlining of portfolio, customers and operations to reduce complexity costs

The ultimate goal of a PE firm is an exit, i. e., the sale of the chemical company acquired earlier, which allows to repay the initial investors. There are three basic models for such an exit, of which two are clearly preferred by investors due to the average higher sales price. One of these is the trade sale, in which the company is sold to a strategic player in the same area. Investors may obtain a premium via this type of exit as the buyer can hope to reap synergies later, allowing him to pay a higher price. Of course, a trade sale requires the existence of strong industry players with sufficient resources and strategies that favor business expansion. The acquisition of Cognis by BASF is a recent example. An Initial Public Offering (IPO) may also be quite profitable for the investors, as the example of the Blackstone acquisition of Celanese followed by relisting in the US has demonstrated. A somewhat second-rate exit is the secondary sale, in which the chemical company is sold on to another PE investor. Obviously, the lack of immediate synergies and the presumably high sophistication of the secondary buyer limit the sales price of this type of exit. An example is the secondary buy-out of Brenntag in 2006. The company CABB, a producer of fine chemicals, even went through two such transactions (in 2007 and 2011).

PE in chemicals in China

While North America and Europe are the key areas for PE in chemicals due to their strong M&A activity, Asia is also an important location. Within Asia, China accounted for 44% of PE deals in the first half of 2011.

While North America and Europe are the key areas for PE in chemicals due to their strong M&A activity, Asia is also an important location. Within Asia, China accounted for 44% of PE deals in the first half of 2011.

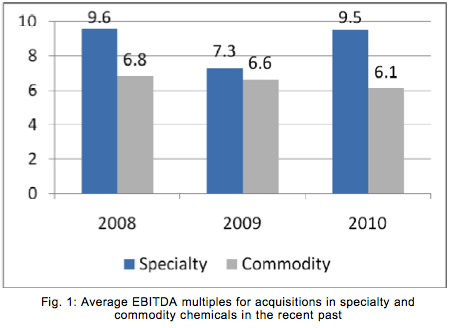

However, overall the value of PE deals in China’s chemical industry is still relatively low. According to Dealogic, a database, there were 263 chemical deals involving PE buyers in the period of 2001 to mid-2011. The total value of those deals with known value (216 deals) was US$5.7 billion less than the value of the single acquisition of Lubrizol by Berkshire Hathaway in 2011. In particular, the majority of deals was below US$10 million (see Fig. 2). Also, there were only 2 deals with a size above US$300 million (topped by the US$600 million acquisition of 20% of Bluestar by Blackstone in 2007).

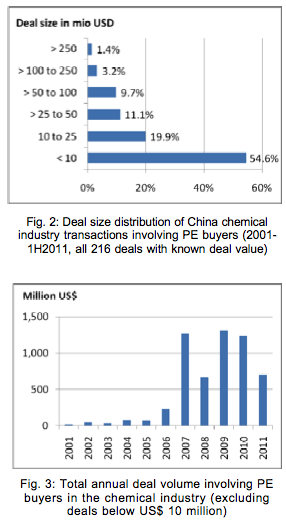

On the other hand, as figure 3 shows, the interest of private equity in the chemical industry is rising, though the general upward trend was somewhat interrupted by the financial crisis.

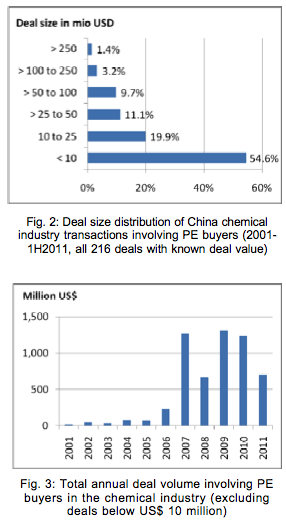

Finally, figure 4 shows that though PE is active in many sub segments of the Chinese chemical industry, there is a certain focus on specialty chemicals and plastics, while commodity chemicals play a lesser role.

These figures illustrate a lot about how private equity investment in China’s chemical industry is different from that in Western markets. In the West, a PE firm typically acquires whole chemical companies in leveraged buyouts. In contrast, PE investment in China is primarily employed to acquire minority shares in private companies with high growth potential. This often limits the typical investment size to US$1050 million for a 10-20% share of a chemical company.

In some way it could be argued that private equity investments in China are more of a venture capital nature than in the West.

While North America and Europe are the key areas for PE in chemicals due to their strong M&A activity, Asia is also an important location. Within Asia, China accounted for 44% of PE deals in the first half of 2011.

While North America and Europe are the key areas for PE in chemicals due to their strong M&A activity, Asia is also an important location. Within Asia, China accounted for 44% of PE deals in the first half of 2011.However, overall the value of PE deals in China’s chemical industry is still relatively low. According to Dealogic, a database, there were 263 chemical deals involving PE buyers in the period of 2001 to mid-2011. The total value of those deals with known value (216 deals) was US$5.7 billion less than the value of the single acquisition of Lubrizol by Berkshire Hathaway in 2011. In particular, the majority of deals was below US$10 million (see Fig. 2). Also, there were only 2 deals with a size above US$300 million (topped by the US$600 million acquisition of 20% of Bluestar by Blackstone in 2007).

On the other hand, as figure 3 shows, the interest of private equity in the chemical industry is rising, though the general upward trend was somewhat interrupted by the financial crisis.

Finally, figure 4 shows that though PE is active in many sub segments of the Chinese chemical industry, there is a certain focus on specialty chemicals and plastics, while commodity chemicals play a lesser role.

These figures illustrate a lot about how private equity investment in China’s chemical industry is different from that in Western markets. In the West, a PE firm typically acquires whole chemical companies in leveraged buyouts. In contrast, PE investment in China is primarily employed to acquire minority shares in private companies with high growth potential. This often limits the typical investment size to US$1050 million for a 10-20% share of a chemical company.

In some way it could be argued that private equity investments in China are more of a venture capital nature than in the West.

Typically the invested amount is utilized to provide capital for faster growth, e.g., for expansion of production facilities or distribution. This also partly explains why PE in China focuses more on specialty chemical segments and other high-growth areas, while in the West the focus tends to be on mature commodity segments. China First Capital’s Statement “In China, PE firms support winners. In therest of the world, PE firms generally try to heal the wounded”, though not specifically addressing chemicals, describes the situation very well. It also hints at another important difference between chemical PE investment in China and elsewhere. In China, the major part of the work of most PE firms is done the moment the investment has been made (“the winner has been picked”).

In contrast, PE firms elsewhere spend a much bigger share of their efforts on working with companies after the acquisition (“healing the wounded”).

To summarize, the chemical industry in China offers substantial opportunities for private equity investment. However, the situation is unlike those in the established markets for PE investment. In particular, there are the following major differences:

* Markets move much more rapidly, making good market analysis even more vital in order to spot attractive investment targets

* PE investments in China will in the near future still primarily focus on obtaining minority shares rather than taking full control. To some extent, this limits the role that PE firms can play in improving the performance of the acquired target

* Targets are more likely to be high-growth companies with lack of capital rather than mature companies with the need for process improvement and cost reduction

* Exiting a chemicals business

* Markets move much more rapidly, making good market analysis even more vital in order to spot attractive investment targets

* PE investments in China will in the near future still primarily focus on obtaining minority shares rather than taking full control. To some extent, this limits the role that PE firms can play in improving the performance of the acquired target

* Targets are more likely to be high-growth companies with lack of capital rather than mature companies with the need for process improvement and cost reduction

* Exiting a chemicals business

will be at least as difficult as in mature markets as the typical minority investment further limits the PE owners in their exit options

On the other hand, the success rate of PE investments is likely to be quite high. After all, PE investment in China can afford to focus on fast-growing companies while in Western markets the targets typically are companies that are stagnating. Private equity investment in China’s chemical industry therefore seems a promising way of profiting from China’s growth that is expected to grow further as the individual investment sizes get bigger. However, the PE industry may eventually have to shift to a more conventional model of PE investment. Even now it already becomes harder and harder to find attractive, fast-growing chemical companies that fit into the PE model currently employed in China.